Robinhood will earn its revenue is through interest in investors uninvested funds in their accounts. Robinhood is collecting 26 cents per 100.

43 Of Robinhood S Q1 2021 Revenue Is From Citadel The Tokenist

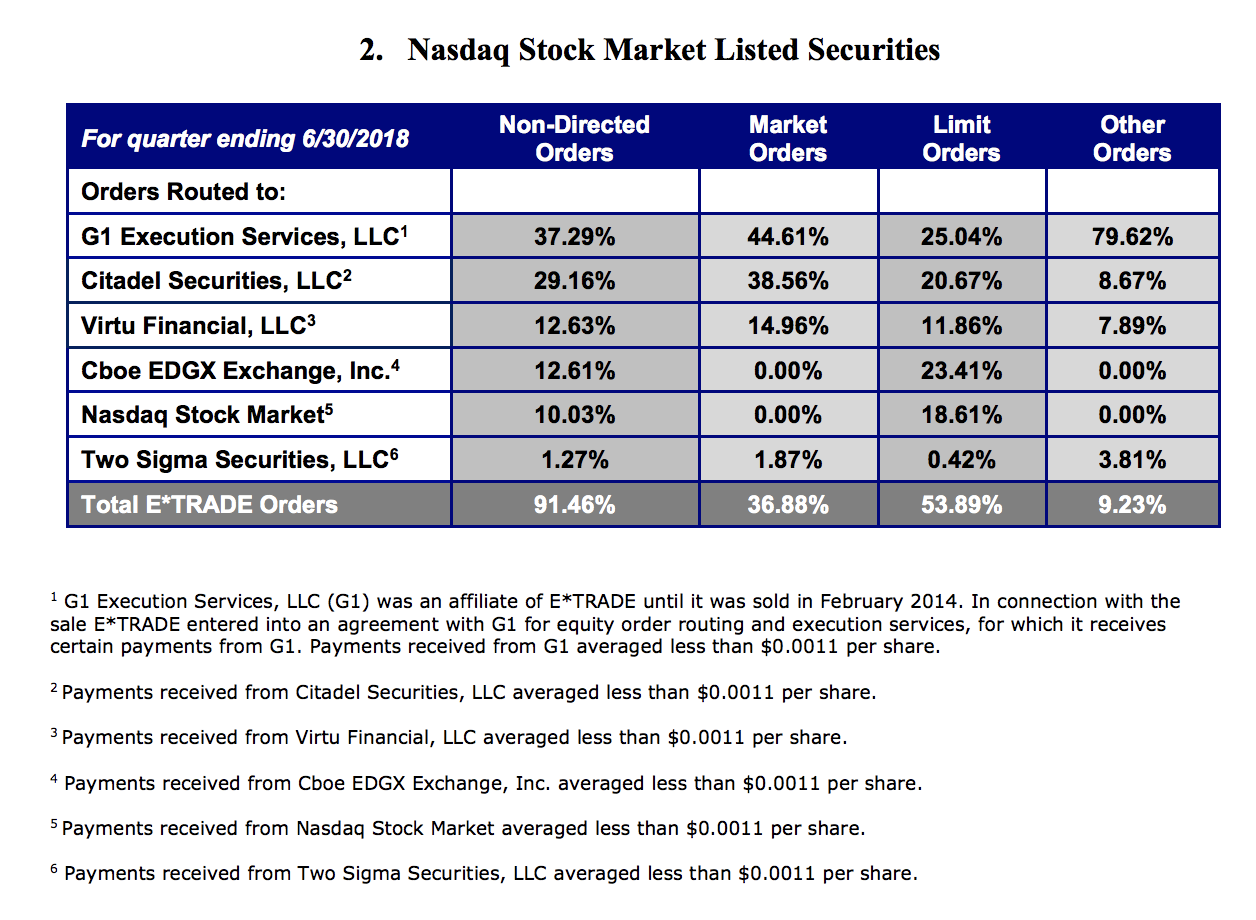

According to Institutional Investor Citadel Securities is one of the market makers Robinhood uses.

How does robinhood make money citadel. Given that Robinhood is playing a central role in retail investors pumping dark horse stocks its worth examining once again how it makes money. Trade routing high frequency trading and order flow is another way Robinhood makes money. The company is a big buyer of customer trades from the leading US retail brokerages such as Charles Schwab and TD Ameritrade which have slashed commissions to zero to keep up with fast-growing.

The majority of that total came from options trading. The magazine said An equity retail trader uses a. When Robinhood directs a transaction to one of these third parties the market maker learns which security is being bought or sold before the trade happens.

So how does Robinhood make money. Instead of giving that price improvement to their customers Robinhood puts it all in their pocketTheyre not a charity - they make money selling your order flow. Namely by selling users trades to.

Robinhood makes money through brilliant revenue idea. Reply Like 2 User 49884989. Citadel and other market makers pay Robinhood a small fee for this privilege which gives the market-making firms information about retail trading patterns.

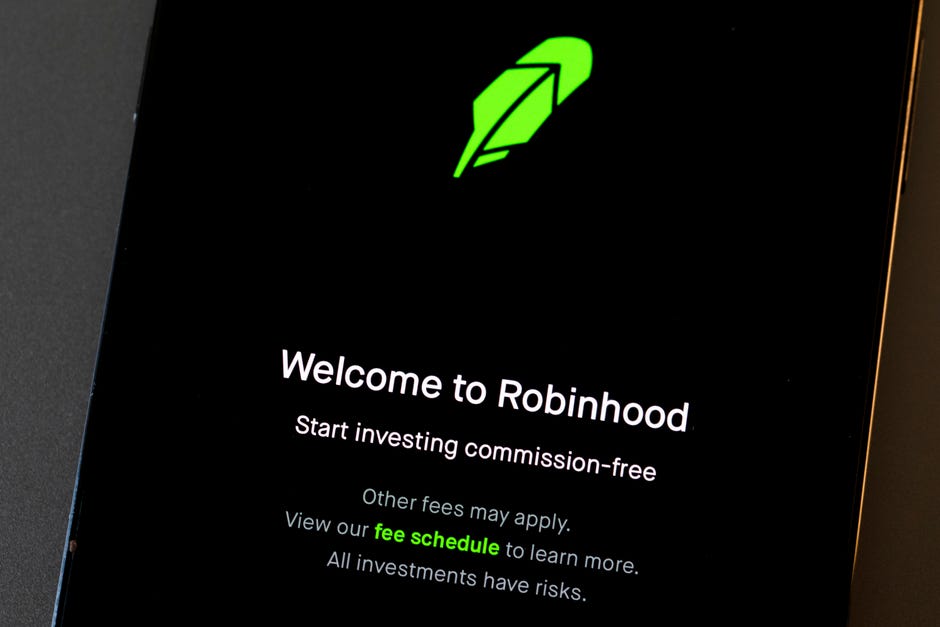

So if its that low then Citadel wouldnt take your order but you can imagine how much they would have to add to your trade to make any money. This disclosure has since changed primarily cause it likely lacks truthfulness. Robinhood roughly doubled the money it makes from customer trades from the prior quarter according to a recent SEC regulatory filing.

These companies also have high-frequency trading arms in the market. With Robinhoods APY being 205. The market maker Citadel Securities is one of the biggest sources of Robinhoods revenue as it pays the no-fee trading app for handling its orders and.

In doing so the only ones who benefited from the surge in retail trading are Robinhood itself by pocketing millions more from selling orderflow to Citadel Virtu Two Sigma Wolverine and other HFT frontrunning market-making venues as well as Citadel which made billions by having an advance look at the biggest surge in retail stock and option orders flow in history and being able to trade. Until 2018 Robinhood had a site on its platform How we make money in which it clarified to users that its revenues came from interest on money deposited in Robinhood accounts as well as from a paid service called Robinhood Gold. Similar to how banks collect interest on cash deposits.

Thats what Robinhood collects by selling your order flow. Citadel and other market makers pay Robinhood a small fee for this privilege which gives the market-making firms information about retail trading patterns. For example if a user buys or sells 100 shares of Pepsi the trade will be routed through specific channels such as Citadel Securities LLP for high frequency trading.

Robinhood earns its revenue this way by depositing uninvested cash into interest-bearing bank accounts. Alternatively Robinhood also generates income from uninvested cash that hasnt been swept to the cash management network of program banks via its Securities division. Robinhood still makes money on this account through interchange fees fees the merchants bank account must pay whenever a customer uses a creditdebit card to make a purchase from their store.

Thus Robinhood does make some money from the fees by the banks and interchanges fees when a customer uses the debit card comes with the service. According to their site Robinhood makes money from interest from customer cash and stocks much like a bank collects interest on cash deposits as. They also make money on fees received from.

Robinhood earns money by routing As of their 4Q16 report they give roughly 30 of their total non-directed orders to KCG 29 to Citadel 25 to Two Sigma and 16 to Apex. This is how Robinhood makes money.

How Does Robinhood Make Money Revenue And Monetization Strategy

Robinhood Nears Biggest Trade Of All An Ipo After Wild Year

Robinhood What To Know About The App At The Center Of The Gamestop Drama Cnet

The Real Way That Free Trading App Robinhood Makes Money Will Surprise You Modern Consensus

A Controversial Part Of Robinhood S Business Tripled In Sales Thanks To High Frequency Trading Firms

:max_bytes(150000):strip_icc()/Fidelityvs.Robinhood-5c61f1a6c9e77c00016626a5.png)

How Robinhood Makes Money Order Flow Interest Subscriptions

Robinhood Backlash What You Should Know About The Gamestop Stock Controversy Cnet

Robinhood Is Said To Get 40 Revenue From Hft Firms Like Citadel Phil Davis

Robinhood Is Making Millions Selling Out Their Millennial Customers To High Frequency Traders Seeking Alpha

Robinhood In Need Of Cash Raises 1 Billion From Its Investors The Seattle Times

/robinhood-1144590831-a9554da859174b1e851a411fb223de1d.jpg)

How Robinhood Makes Money Order Flow Interest Subscriptions

How Does Robinhood Make Money Revenue And Monetization Strategy

How Does Robinhood Make Money Are They Legit Wall Street Survivor

Robinhood Pinching The Poor To Fatten The Rich

Robinhood Citadel Partnership Likely To Draw Scrutiny After Gamestop Trading Halt The Washington Post

How Does Robinhood Make Money Thestreet

The Millenial Robinhood Take From The Poor And Give To The Rich By Sid Venkateswaran Medium